PCI DSS Compliance

PCI DSS Compliance

Why do we need PCI DSS Compliance ?

PCI DSS 2 Key Components:

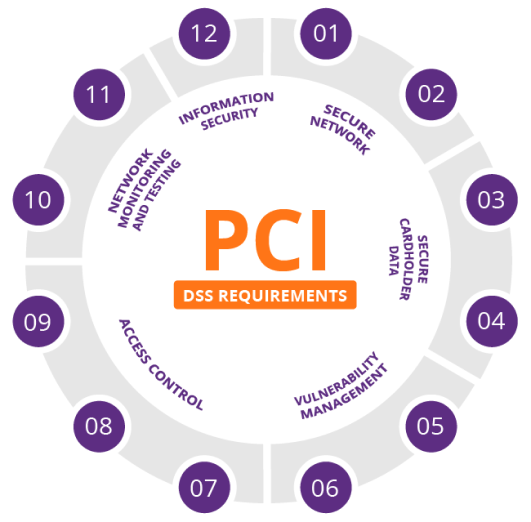

1. Security Standards: PCI DSS outlines requirements across 12 high-level security standards, covering areas such as network security, access control, encryption, regular testing, and maintaining secure systems and applications.

2. Protection of Cardholder Data: The standard requires the implementation of robust measures to protect cardholder data. This includes encryption of data both in transit and at rest, limiting access to sensitive information, and maintaining secure storage of payment data.

3. Network Security: Organizations must maintain secure networks, including using firewalls, avoiding default passwords, and implementing network segmentation to protect cardholder data.

4. Vulnerability Management: Regularly scanning for vulnerabilities, conducting security assessments, and patching systems to address identified weaknesses are crucial aspects of compliance.

5. Access Control: Limiting access to cardholder data to only those who need it for their job, assigning unique IDs, and implementing strong access control measures are required.

6. Regular Monitoring and Testing: Continuous monitoring, logging, and auditing of systems are necessary, along with regular testing of security systems and processes.

7. Compliance Validation: Organizations handling payment card data need to validate compliance annually. This can involve self-assessment questionnaires or, for larger entities, on-site assessments by qualified security assessors.